First published 13 April 2019. Figures updated for July 2023.

In moving to Ireland, and seeking to be employed in something that is outside of my professional training, I didn’t know I was consigning myself to minimum wage jobs.

Today was my first official day working at a local castle-turned-hotel. Wow. It is such a beautiful building to work in! I had forgotten how inhospitable hospitality is – especially your feet.

As with most hospitality businesses, they pay minimum wage to their staff. Fine, your business needs to be profitable, I understand, otherwise no one has a job. But if you are going to pay your staff minimum wage, then know that instead of an economic price, you will pay in different ways.

One cost is turnover – staff have zero loyalty to a combination of holier-than-thou management and also a wage that means their quality of living is less than zero. In a country where the minimum wage is €9.80 (now €10.50 as at July 2023), so working 40 hours a week you make €380-390 in hand, or €1554 a month – assuming that you consistently get 40 hours – no guarantee. The average rent in Dublin is €1600 per month (2023 average: €2337 or NZD$4182/month).

I am reasonably easy to incite to anger, I understand that, but surely that math is problematic. You have no hope affording rent to live alone, heaven forfend if you want to eat or anything else, so automatically, you’re relegating a percentage of the population to sharing accommodation, and all the vagaries that come with that.

So if a living wage is €11.90 €13.85/hour, let’s do the same maths

40 hour work week: 554 gross, 496 net

Monthly: 2149 net

Yearly: 25 794 net

So if you were a single person who is just trying to live in a one bedroom studio by yourself, that is probably going to be tight, even at living wage, assuming you have consistent hours, and are able to keep your job and fun things like that.

Income: €2149

Rent: €1300/month

Mobile €20/month (ours is 25/mth each)

Internet €45/month (ours is 80)

Power €~150/month (ours is about 300/month atm)

This leaves you with €633 to spend on all of your other food, medical, and fun expenses a month.

The biggest outgoing out of anyone’s paycheck will certainly be rent. Ours is €1450, and that is ‘cheap’ (we live in the city now, and pay €1950/month). We looked at around 12 properties before we found one that we thought that worth the sizable investment that we were being asked to make – well over 50% of our final paycheck will be spent each and every month on rent (not quite true now, as we have a flatmate in, and I’m earning more now than I was when I first wrote this cos I caved and went back to teaching).

The cheapest broadband each month was €25 a month, then goes up after 6 months – not that your salary does – to €45 a month.

Mobile phone needed for every job ever and most applications – minimum €10 a month, €30 if you want to be able to text/call/use data.

You’ll probably need some power. We haven’t had to pay a power bill yet so I don’t know how much that is but if you refer to the average for a 1-2 bed apartment, it’s around €100.

So yes, assuming that you are not shackled with debt, and aren’t planning to do copious amounts of spending, you can exist while working full time on living wage.

But let’s do those figures again, but on Minimum Wage.

Minimum wage is €10.50 an hour.

If you’re lucky enough to get full time hours, and consistent hours then you can expect

40 hours: €420 gross, €396 net

Monthly: €1714 net

Annually: €20 569 net

All your bills are still the same price, though.

Income €1714

Rent: 1300/month

Mobile 20/month

Internet 45/month

Power ~150/month

You’re then left with €199 a month to feed and clothe yourself, and maybe have a little fun, join a gym, go on holiday, all of that kind of jazz. Certainly, if one was a single adult supporting themselves, this would be possible, maybe. But when you’re a single mother, or even with two incomes like this trying to support children this becomes nearly impossible, particularly if you have to pay for childcare.

Cheapest ‘apartment’ on Daft is currently €912 a month for a cramped studio.

If you are looking for a room in a shared room in a house, then you can grab a bargain for €150/week (still ~600/month to share a room with someone – that landlord is killing it – €1200/room/month!) then you might be able to eat, and share other bills. There are some cheaper options than that, but then you start getting into some seriously tiny spaces, or sharing with some sometimes quite questionable people.

Perks of being poor?

No wonder there is a person homeless on every street corner in town. The economics of poverty, and presumably disconnection here are very severe.

What are the consequences of this though? This is becoming true of nearly every Western culture, certainly in the Anglosphere. If the lower/middle class’s spending power is completely eviscerated by giving it all to landed gentry every month, then were will that leave us? Who will buy all the books on Amazon and all the iphones if everyone is spending all their money on rent/bills?

I believe we’re getting closer and closer to a social revolution. Right now, people are just doing their darnedest to get by, but much more and there will be a tipping point. (After the incredible energy price hikes and interest rate rises post-Covid, we must be closer.)

Is our idea of what is considered poverty quite modern and warped though? Did poverty use to be much worse? Is poverty in fact living with out internet or a phone?

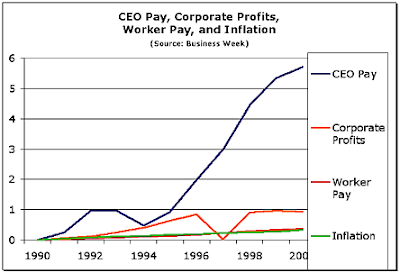

Maybe it was just CEOs that were poorer, as they’ve certainly been doing a very good job of changing this.

If we were to introduce something like a Universal Basic Income, would this alleviate this, or would it simply push up the price of rent even further?

How is ‘market rent’ established anyway – isn’t it just a collection of ‘yea, wow that’s steep, but I guess I’ll pay that because somewhere to live is better than nowhere to live’? And if everyone does that then that’s how landlords get away with 8% rent increases each year. Is this one of those instances where we need to collectively start saying no? Or will we then all just end up homeless?

I think corporate greed will be the undoing of us all unless it is severely legislated against. If only we had some pithy lawmakers that weren’t completely falling all over themselves to help CEOs of big companies be overlords of their little serfdoms.

This is obviously a complicated problem with no easy solutions, but being aware of the problem is the first step, and somewhere in the steps is unionising/protesting, and some industries have been doing, notably in the UK.

This article outlines that across the OECD in 2023 there has been a real-time loss in wages between 2022-2023 of -3.8% of purchasing power. Have you had a pay increase of more than 4% to compensate for this?

What’s your fix to this? I’d love to hear it.

References:

Article from Focus Ireland about comparing homelessness statistics

The history of minimum wages – NZ was the first place in the world to have a minimum wage in 1894

The history of the minimum wage in NZ

OECD average of -3.8% of wage growth between 2022-2023 (and that’s just one year?!?!)